Securing Your Possessions: Trust Fund Structure Know-how at Your Fingertips

In today's complicated economic landscape, ensuring the security and development of your properties is extremely important. Count on foundations function as a keystone for securing your riches and heritage, offering an organized strategy to possession security. Competence in this world can offer vital support on navigating legal complexities, making the most of tax obligation effectiveness, and producing a durable monetary strategy customized to your distinct demands. By taking advantage of this specialized understanding, individuals can not just safeguard their possessions effectively but likewise lay a strong foundation for long-lasting riches preservation. As we discover the intricacies of trust fund structure experience, a globe of opportunities unravels for strengthening your monetary future.

Significance of Trust Foundations

Trust structures play an important duty in developing credibility and fostering strong connections in different professional settings. Structure trust fund is necessary for companies to flourish, as it develops the basis of effective partnerships and partnerships. When count on exists, people feel more certain in their interactions, causing increased productivity and effectiveness. Trust structures act as the foundation for honest decision-making and clear interaction within companies. By focusing on trust fund, companies can produce a positive job culture where staff members really feel valued and valued.

Benefits of Professional Assistance

Building on the structure of rely on expert partnerships, seeking specialist advice provides indispensable advantages for individuals and organizations alike. Specialist advice supplies a wealth of understanding and experience that can help browse complicated financial, lawful, or critical difficulties effortlessly. By leveraging the proficiency of experts in numerous areas, people and companies can make informed decisions that align with their goals and desires.

One considerable benefit of specialist guidance is the capacity to access specialized knowledge that may not be readily offered or else. Professionals can offer understandings and point of views that can cause innovative remedies and chances for growth. Additionally, collaborating with experts can assist mitigate risks and unpredictabilities by offering a clear roadmap for success.

Moreover, professional assistance can save time and resources by simplifying processes and staying clear of expensive mistakes. trust foundations. Experts can provide customized recommendations tailored to certain needs, making sure that every decision is educated and tactical. In general, the advantages of expert assistance are complex, making it a useful asset in protecting and making the most of properties for the long term

Ensuring Financial Security

In the realm of financial preparation, safeguarding a secure and flourishing future rest on calculated decision-making and prudent financial investment options. Guaranteeing monetary safety and security entails a diverse technique that incorporates numerous aspects of wealth monitoring. One vital component is producing a varied financial investment portfolio basics tailored to private risk tolerance and financial objectives. By spreading out financial investments throughout various asset classes, such as supplies, bonds, actual estate, and assets, the danger of considerable financial loss can be reduced.

In addition, preserving a reserve is necessary to safeguard against unanticipated expenses or revenue disturbances. Professionals recommend alloting three to six months' well worth of living expenditures in a liquid, quickly accessible account. This fund functions as an economic safety web, offering peace of mind during unstable times.

Routinely assessing and adjusting financial plans in action to changing circumstances is also vital. Life occasions, market variations, and legal adjustments can affect financial security, emphasizing the importance of recurring assessment and adjustment in the quest of lasting economic safety and security - trust foundations. By read this post here carrying out these methods thoughtfully and continually, people can strengthen their economic ground and work in the direction of a more protected future

Securing Your Assets Efficiently

With a strong foundation in position for financial safety and security via diversification and emergency fund upkeep, the next important action is safeguarding your assets successfully. Protecting assets includes shielding your wide range from possible dangers Check This Out such as market volatility, financial recessions, lawsuits, and unanticipated expenditures. One reliable method is property appropriation, which includes spreading your financial investments throughout numerous asset courses to lower threat. Expanding your profile can aid minimize losses in one area by stabilizing it with gains in one more.

Additionally, developing a depend on can offer a protected way to protect your possessions for future generations. Counts on can aid you manage how your properties are dispersed, lessen inheritance tax, and protect your wide range from financial institutions. By applying these methods and seeking professional guidance, you can secure your possessions efficiently and secure your economic future.

Long-Term Asset Security

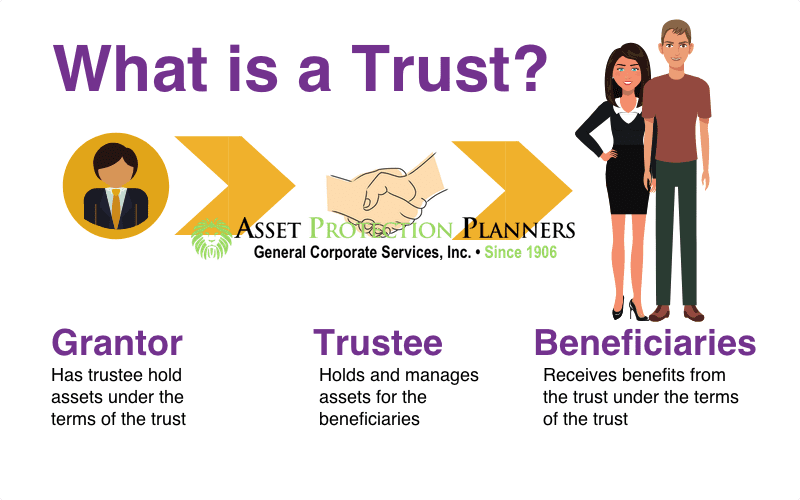

Long-term asset protection entails implementing actions to protect your assets from various risks such as economic slumps, claims, or unanticipated life events. One crucial aspect of long-term asset security is developing a count on, which can use significant advantages in securing your assets from creditors and lawful disputes.

Moreover, expanding your investment portfolio is an additional crucial approach for long-term possession security. By taking an aggressive method to long-term asset security, you can safeguard your riches and offer monetary security for yourself and future generations.

Verdict

In final thought, trust fund foundations play a critical duty in safeguarding properties and guaranteeing economic protection. Specialist assistance in establishing and taking care of trust structures is essential for lasting property defense.